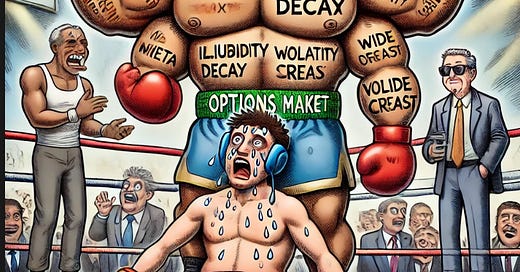

I stepped into the world of options trading like a rookie boxer convinced I was about to fight a harmless featherweight. I’d read the stats—low margin requirements, the potential for huge gains, all that good stuff. Everyone made it sound like a smarter, more flexible way to trade.

I grinned as I laced up my gloves, thinking, This is going to be easy.

Then the bell rang.

Round 1: Illiquidity—The Ghost Opponent

I threw my first punch—placed a trade, confident in my strategy. But nothing happened. The market just stood there, silent. No one wanted to take the other side.

Ever tried fighting a ghost? That’s what trading illiquid options feels like. You swing, but there’s nothing to hit. I had picked contracts with an open interest of about 17—probably just me, the market maker, and some guy who forgot to close his position back in 2014.

I tried adjusting my price to get filled. No luck. By the time I got a match, the market had already moved.

Ding! End of round one. I hadn’t even landed a punch.

Round 2: The Bid-Ask Spread Uppercut

Still confident, I stepped in again. This time, I noticed something weird. The stock price was at $100, but the call option’s bid was $2, and the ask was $2.50.

Wait, what?

I was trying to buy at $2, but the sellers wouldn’t budge from $2.50. That 50-cent spread might not sound like much, but in options, it’s the difference between an even fight and getting smacked in the face before you can even raise your gloves.

Desperate, I gave in and bought at $2.50. Then, two seconds later, the spread moved against me. If I tried selling right then, I’d only get $2.

I had just paid an invisible tax.

Ding! Another round lost.

Round 3: The Silent Killer, Theta

At this point, I was getting frustrated. I decided to hold onto my position for a while, let the trade work itself out.

Big mistake.

What nobody had told me was that theta decay is like a vampire. It drains the life out of your position slowly, silently, and mercilessly. Every day, my call option was worth less—like a melting ice cube in the Sahara. I wasn’t even losing because of market movement. I was just sitting there watching my money evaporate.

It hit me: This isn’t trading. This is slow financial torture.

Ding! Another round down. My knees were starting to wobble.

Round 4: Volatility’s Fake-Out Punch

Okay, so theta was bad. But I had heard volatility could save me. If the market suddenly made a big move, my options would surge in value!

Except… it didn’t.

The stock did move in my favor, but instead of my options exploding in value, the premium barely budged. Why?

Because implied volatility had dropped.

I had expected a knockout punch. Instead, I got a gentle shove. Like pushing a mountain and expecting it to fall over.

By now, I was reeling. My account was bruised, my confidence was on life support, and my trading strategy looked like it had been hit by a truck.

But my opponent? He was just warming up.

Final Round: Reality Goes Full MMA on Me

At this point, I realized my opponent had all the rules memorized. Every loophole, every trick, he knew them by heart. And just to make things worse, his coaches and assistants were shouting tips to him from the side of the ring.

Meanwhile, I was running for cover.

He wasn’t just throwing the usual punches anymore. He was unveiling newer and newer techniques from his repertoire. His strikes were like lightning—hooks, jabs, crosses, uppercuts. They kept coming.

Wait… was he even throwing kicks now?

"Hey, where’s the ref?!" I yelled, trying to shield myself from the onslaught.

The referee gave me a half-hearted "Calm down, kid." the first time. Then, as I continued getting pummeled, he just plain ignored me.

I staggered back, barely able to stand.

Lessons from the Knockout

It was time to admit it. I had walked into the ring expecting to outthink the market. But options weren’t some easy underdog—they were a seasoned, brutal fighter with years of experience knocking out overconfident traders like me.

I stepped in expecting a street brawl. What I got was an absolute MMA beatdown, complete with market makers throwing flying kicks and volatility smashing steel chairs over my head.

I limped away, bruised but wiser. Options trading can be profitable—but not for the overconfident newbie expecting a quick win.

Will I step back in the ring? Maybe.

But next time, I’ll train first.